The UBM headquarters is bustling with excitement and preparation for the hallmark second edition of the Mumbai Jewellery & Gem Fair. With important partnerships, expansive promotional activity in addition to the newly added aspects, this fair is sure to b

The unprecedented global recession which has effectively ended a period of feisty and bubbly economic growth across the world, has forced nations to revive their economies with new business opportunities. For the Indian jewellery industry, this has meant tracking new demands in countries which it had hitherto serviced cursorily. For decades the Indian jewellery industry had traded almost exclusively with the US market, with the American market consuming almost 50% of the world’s jewellery. But with the US market plunging into a financial quagmire, the search for new markets has become intense.%%

Indian jewellers, along with officials of the Gem and Jewellery Export Promotion Council (GJEPC), are surveying new markets and analyzing them for growth. Delegations have fanned out to Russia and the Commonwealth of Independent States, China and the Middle East. Asian countries like Vietnam, Singapore and Taiwan are also being considered as markets of moderate potential. Reports have been written and presentations amplified by research have been made on the emerging markets of which the most favoured are Russia and the CIS states, the Middle East and China. The markets are still being researched extensively and the Gem and Jewellery Export Promotion Council plans to share its research with the industry as soon as its surveys are complete. But preliminary reports shared by the Council with this correspondent, including interviews conducted with some members of the delegations which toured these countries, suggests that these are markets of rich promise. Diamond World presents relevant aspects of this research in three sections for easy dissemination.%%

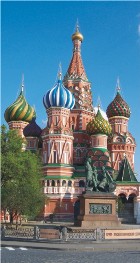

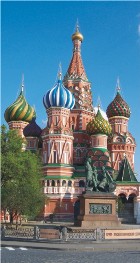

{{Russia & the CIS states :}}$$

A delegation headed by Hemant Shah, Co-convenor, PMBD, GJEPC, visited Russia, Serbia and Azerbaijan from December 4-December 13, ’08. In Russia the delegation visited Moscow and St. Petersburg and interacted with business leaders, especially in the luxury lifestyle segment. Russia is considered a complex market by any standards with business opportunities in various segments like diamond polishing, jewellery production and retailing. Famous brands of jewellery are well-represented in Russia with seven boutiques of Graff, two boutiques of Van Cleef and three boutiques of Cartier. Despite import tariffs and VAT, the Russian government has deftly stabilized prices to ensure that luxury goods cost the same in a Russian store and a shop in the country of its origin, for instance, an 11ct diamond will cost the same in a London or Moscow store of Cartier. %%

{{Market with deep pockets}}$$

According to industry sources, the Indian jewellery industry has not explored the humungous markets of Russia and the CIS states which have clients with proverbially deep pockets. But the flipside is that the Russian market, in particular, is controlled extensively by the grey market. However, as business between these countries and India is finessed into a profitable relationship, the grey market could become virtually extinct. Says Shah: “The US market will not revive for a while. Even if we get only 20% or 30% of the business that we had with the US, it will help us to offset the losses that we have made in the American market.â€%%

The retail mark-up in Russia is 2.6 times the landed cost of jewellery, but despite these stiff prices, jewellery sales in Russia have recorded a sharp increase of 35% over the last five years. However, the import tariff of 25% and VAT of 18% are a formidable deterrent to business. Rahul Desai, general manager, Rosyblue, who was a part of the delegation, remarks that “it is the logistics and the high tariffs which make business in Russia and the CIS states tough. We have told their jewellery councils to induce their governments to reduce the tariffs, only then can we do business with them.†Desai elaborates further that both Russian and CIS customers show a marked preference for only high-end goods, unlike American consumers who will purchase both luxury and cheap goods. Russian customers will buy diamonds of only SI and VS quality or a few notches upward and steer clear of cheaper goods.%% {{Daunting logistics}}$$ Most jewellery retailed in Russia is purchased from Italy, Turkey and Dubai. Silver jewellery targeted at the lower segment of the market is bought from Thailand. Large manufacturing facilities exist in the country, but the products are of moderate quality. Indian jewellers who wish to trade with Russia must focus on Moscow and St. Petersburg which are buying and selling centres. The Indian jewellery industry will also have to tread warily through the tangled network of the Russian customs duty system. This is an extremely complex system with elaborate invoicing requirements which stress detailed descriptions of goods with gold weights, diamond weights, etc. Legal expenses too are remarkably high – some companies like the Richemont Group spend 15% of its turnover on legal fees. However, one of the most formidable obstacles that one has to overcome in trading with Russia and the CIS states is the lack of knowledge of the English language. Indian jewellers will therefore, of necessity, have to acquire a working knowledge of the Russian language.%% Indian jewellers who wish to foray into the Russian and CIS markets must participate in the Moscow and Restec Junwex trade fairs. The latter exhibition will also be held at St. Petersburg between September 12-17, ’09 and GJEPC is already negotiating for space at this exhibition. Jewellers who wish to participate will be able to do so with prior permission of the Council.%% {{CIS states will grow}}$$ In CIS states like Serbia and Azerbaijan, gold and silver jewellery are preferred with meager consumption of diamond jewellery. The diamond jewellery sold in most shops is of SC or white PK quality. The local population also has a marked preference for costume jewellery. However, the landing cost of goods is stratospheric at 40%, with 18% VAT and 20% import tariffs. Like Russia, language is a formidable obstacle to business as the local population is almost completely ignorant of the English language. But in this era of shrinking markets and shriveling demands, the CIS states present tempting business opportunities. Hemant Shah believes that “Azerbaijan alone is a US$30 million market now even when it is not yet fully developed. When we start penetrating, these markets will only grow.â€%% For carefully orchestrated growth, Indian jewellers need to strategize astutely. Observes Shah: “For starters, they must visit these countries at least once or twice a month to acquaint themselves with these new markets and understand how to do business there. Then a change of image is required, because the impression there is that Indian jewellery and Indian services are not good. We changed our image in the US and Europe, we can do it here too.†He also believes firmly that if Indian jewellers create markets based not on price points, but on value and innovation, success will not lag behind.%%

{{The Middle East :}}$$ India has ancient ties with the Middle East whose residents have always favoured Indian jewellery. Hence the Middle East is a ready and ripe market for the Indian jewellery industry. Anurag Vaish and M P Anand, partners in the consultancy firm, Final Mile, surveyed the region and prepared an exhaustive report for the Gem and Jewellery Export Promotion Council.%% {{World’s fastest growing market}}$$ Vaish firmly believes that the Middle East is one of the fastest growing jewellery markets in the world, with the potential of being a stupendous $10 billion market for jewellery products. He remarks that the region has certain undeniable advantages: “Dubai, where most jewellery is sold, can be easily accessed from India. Abu Dhabi which is a part of the UAE, has one of the largest sovereign funds in the world for investment, while Saudi Arabia is slated to have at least 3% or 4% growth in 2009.â€%% With the thirst for oil across the world being insatiable, the economies of these regions are only destined to grow. The UAE is now considered a significantly large market, with the potential for growth looming large in Kuwait, Bahrain and Saudi Arabia too. A difference of the utmost importance between the Middle East and American markets is that the former consumes both gold and diamond jewellery, while the latter market favours only diamond jewellery. “So while the American market does business mainly in polished diamonds from the Mumbai and Surat markets,†points out Vaish, “the Middle East market with interests in both gold and diamond jewellery will give business to the entire jewellery industry in India.â€%% {{Parameters for growth}}$$ India is one of the largest exporters of jewellery to the Middle East, pushing fierce competitors like China and Italy into second place. But India also has to be wary of intense competition from Malaysia, Thailand and Turkey which have improved their jewellery to suit Middle Eastern tastes. The Middle East could be a very profitable market for Indian jewellers if they consistently produce mid and high-end jewellery of excellent quality. Like Indians, customers in the Middle East prefer 22kt. gold, with a penchant for Indian designs. But Middle Eastern customers are sniffy about delicate designs, warming only to big, chunky and elaborate jewellery.%% According to Dinesh Lakhani, director, Kiran Gems, if India improves the quality of its jewellery “it can control 45% of the market in the Middle East in the next three or five years. In fact, we can beat China in this market!†Along with improved quality, India also has to devise a meticulously planned promotional campaign to lure customers of this region to buy its jewellery.%% {{People’s Republic of China :}}$$ In the recent past, a delegation from GJEPC and two Indo-China diamond buyer-sellers meets in December ’07 and September ’08 respectively visited China to acquaint themselves with market conditions. The delegates were impressed with the Chinese diamond industry and were upbeat about India’s prospects in that market. They visited Shenzhen, the hub of trading and jewellery manufacturing in China. Shenzhen is close to Panyu, which accounts for 60% of China’s exports.%% {{Impressive potential}}$$ The delegates were impressed with the potential of the Chinese diamond market. A fair number of Indian jewellers have offices in Hong Kong and have been researching both the Chinese and Far Eastern markets continuously. These jewelers believe that with the decline of the American market, India should explore the Chinese market for growth. Lakhani notes that “when Chinese girls marry, they have to buy diamond rings and this makes China a good market for diamonds. Diamonds of VVS, VS and SI+ quality enjoy the maximum demand in that country.â€%%

China does not have polishing facilities for diamonds and Lakhani predicts that it will take ten years for that country to equal India in this regard. “We should exploit this opportunity,†he emphasizes, “and at the same time improve our jewellery manufacturing and workmanship.†Vijay Shah, partner, J B Brothers, notes with satisfaction that with the proliferation of Indian diamond houses in China “it won’t be long before we capture this market.â€%%

The chairman of the Gem and Jewellery Export Promotion Council, Vasant Mehta, critically analyses the Chinese market “as a great market once it opens up and the duties go down – but it will take at least three years for the market to open up. Under the rules of the WTO, the Chinese government is bound to reduce these duties – but when will that happen?†He underscores that loose diamonds have a very lucrative market in China; when the market turns liberal, Indian jewellers may strike it rich as Chinese manufacturing facilities will not be able to fulfill the overwhelming demand of its domestic market.%%

Emerging markets is a hot-button issue for the Indian jewellery industry. It urgently needs to scour new markets which in these troubled times could orchestrate its growth. %%

{{-with inputs from Gem and Jewellery Export Promotion Council}}%%

Be the first to comment