Sean Gilbertson, CEO, Gemfields

Sean Gilbertson, the newly appointed CEO of Gemfields, in an exclusive interview after the company delisted itself from the London Stock Exchange, talks about the company’s future plans with Arpit Kala, Associate Publisher, Indian Jeweller.

A veteran at Gemfields, Sean Gilbertson who recently was appointed as the Executive Director of Pallinghurst Resources Ltd, also took the reins over Gemfields as its CEO. After the Pallinghurst takeover, Gemfields held its first auction last month in Lusaka and earned $21.5 A veteran at Gemfields, Sean Gilbertson who recently was appointed as the Executive Director of Pallinghurst Resources Ltd, also took the reins over Gemfields as its CEO. After the Pallinghurst takeover, Gemfields held its first auction last month in Lusaka and earned $21.5

AK: Can you walk us through Gemfields’ new development projects?

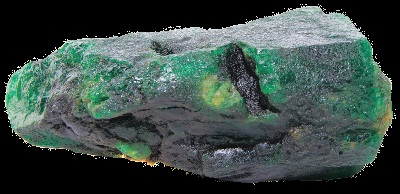

SG: We are pushing forward with Ethiopia where we have discoveredemeralds. We don’t know as yet if the deposits are going to be economically viable; we hope that it will prove to be a bonus for us at some point in the next two years. We are pushing ahead with our second ruby property, which is in Mozambique and called Megaruma. Several million dollars are going into the development stages of that deposit. We are also spending additional money on another deposit, not on the Kagem license in Zambia but across the river on a license called Mbuva- Chibolele. That again we hope will be a bonus and we hope to see some production in the next 18-24 months. These are our new development projects with no revenue at this point but which will continue to open up.

AK: What about your projects in Colombia and Sri Lanka?

SG: We are not proceeding with Colombia for various reasons. The emerald sector there has a lot of potential, as does the country, but it is not always easy to operate in and the history of the emerald business there has some legacy issues which may not necessarily be filtered out of the system in its entirety. Similarly, we are not working in Sri Lanka because of systemic and structural reasons -it has a strong culture of small-scale mining and of keeping the resources in reserve for future generations, which we respect. We do not wish to work against the stream or uphill. If the industry, the people and the Government don’t wish to see the deposits develop via large scale mining, who are we to blow against the wind?

AK: The last financial year saw a decline in revenue; what according to you is the reason?

SG: The revenues are down 18 per cent for the Gemfields Group as a whole. The principal reason for the decline in revenue comes from the Kagem emerald mine. The Kagem emerald mine suffered a decline in revenue from a $ 102 million to $ 48 million year on year. So, there’s a huge drop here of revenue of $ 54 million. That had an impact on the wider group. The group’s revenue went down by only 18 per cent despite a more than 50 per cent revenue decline at Kagem, meaning the group overall was very robust despite that challenge, which I take as a pretty good sign. According to portfolio theory, you have got to have your eggs in different baskets because if there is a problem in one area, you get saved by another.

AK: Did Indian demonitization have a strong impact on Gemfields’ business?

SG: The biggest impact demonetization had on Gemfields was to cause a 60- day delay in a sale. So, we had originally scheduled an auction in December 2016. And in November a statement was made about demonetization, a very bold move, which obviously caused a lot of surprise and shock in the market. In the ensuing few days, we waited for the response of our customers and they were obviously surprised as well and it naturally takes a bit of time to adjust to something like this. And for that reason we decided that it wouldn’t make sense to go ahead with the auction in December 2016 and we delayed the auction to February 2017. We are talking about a 70-day delay. That was the principal impact of Indian demonetization on Gemfields. And I do think it is fair to say that in the February auction, in the ensuing turbulence of Indian demonetization, there was an understandable degree of uncertainty and nervousness amongst our customers. Therefore, we undoubtedly saw lower prices in February than we would’ve otherwise seen. I think that impact was noticeable but I can’t describe that as having been a major setback. It is a circa 15 per cent price change, something along those lines. But in our recent auction, 2 weeks ago, in Lusaka, we put on sale the smallest amount of carats we have ever offered at a high-quality auction and we got almost - within 5 per cent the same revenues we got back in February despite offering far fewer gemstones last month. The price that we achieved two weeks ago, was in fact, per carat, the second highest price we have ever achieved. So here we are in October 2017, and Indian demonetization was in November 2016, and I can’t tell you that there has been any significant, ongoing, lingering, hangover effect of demonetization. From our perspective, at this point in time, subject of course to any other shocks that might come out of any system, anywhere in the world, it is business as usual. Kagem last year only did $ 48 million in revenue and the operating costs were $ 32 million. Even at those reduced numbers, and after adjusting for cost-of-goods sold, Kagem’s operating loss of $8 million shows how erratic emerald mining can be. Can we say it’s going to be rectified in the nex 12 months? I can’t guarantee it. But I do hope history repeats itself, because we have in the past had one bad year, followed by one good year and then hopefully we should be okay.

AK: So, would you say that Gemfields is not in any immediate financial danger at the moment?

SG: I understand the business pretty well and I have been involved with Kagem for 10 years and with Gemfields since we made the reverse takeover of Gemfields by selling Kagem to Gemfields and taking shares in Gemfields in return, which was in July 2008. The idea that Gemfields is in perilous financial straits is inaccurate - you can see that from the most recent revenue and our auction figures and we have of course published our production costs, meaning people can do the math. So provided, we continue to get reasonable production levels out of the various mining operations, all will be well. Are we carrying more debt than we would like to be carrying? Yes, absolutely. And the parent company of the Gemfields group, Pallinghurst, is a very debt averse business - it does not have debt on its own books. There is an old saying that you do not mix debt and hard rock mining. So, Pallinghurst does not want to see debt at Gemfields. Again, and this is a matter of public record – Gemfields today has gross debt of about US $80 million, which should be seen in the context of $158 million of revenue and its financial metrics. We will work in the course over the next two years to reduce that debt level, and the speed of doing so will depend on our production levels.

AK: There was some speculation regarding the valuation of inventory as well?

Â

SG: The valuation of inventory under the accounting standards by regulation has to be done at the lower of the cost of production and the net realisable value. This is something we have stuck to very closely at Gemfields. And you will see if you continue to monitor these figures, as we generate the revenues that those stock figures are in the books at our cost of production. In other words, we believe that our net realisable value is higher. To the lay analyst who looks at the figures, they will quite correctly say that 80 per cent of the production is beryl, which is not worth a lot. The fact is (and I perhaps say this flippantly), it is almost irrelevant whether or not you sell your beryl, it is the bottom 80 per cent of the weight, but only a small proportion of revenue. This morning, at the ICA Congress, in one of the slides, I said that 70 percent of Kagem’s revenue comes from the top 7 per cent of the weight, meaning the bottom 93 percent of weight makes up the other 30 percent of revenue. If you take out the top 7 per cent of weight (which is 70 per cent of revenue) and then you take out the next 13 per cent of weight, that bottom 80 per cent of weight really is not that important. While we are obviously not going to do it, one could almost put that fraction back into the ground and not have a really big impact on the overall revenue picture.

AK: Any plans of relisting Gemfields?

SG: We do not plan to relist Gemfields on the stock exchange for the foreseeable future. It will remain a wholly owned subsidiary of Pallinghurst Resources Ltd, which is listed on the Johannesburg Stock Exchange. But Pallinghurst has stated that it intends to seek a premier listing on the London Stock Exchange during the course of 2018. There can be of course no guarantee that the company will be admitted by the LSE, but we hope it will be.

AK: Fabergé also happens to be a loss making entity up until now; why do you think that is?

SG: Fabergé remains as one of the most renowned heritage brands on the planet. It is not possible to reposition a brand like that in a short span of time. Fabergé has made great strides since 2009, when the business was officially re-launched. The company has been in business for just over eight years and it is has already been an award winning brand in the

watch business; it has won the Grand Prix d’Horlogerie de Genève on two occasions in 2015 and 2016 and also has a watch that has been shortlisted for 2017. It has also been lucky enough to garner a number of awards in the jewellery category. It remains a loss making business and probably will be for the next couple of years. It takes time, but the gap is closing and if you look at the development of any key heritage brands in history, it is not something that happens in a “New York moment minuteâ€, it takes time and funding. However, Fabergé has been instrumental for Gemfields in helping the perception and the positioning of precious colour gemstones. So, Fabergé has helped in putting emeralds, rubies and sapphires back on the map, where they should be. Ten years ago, diamonds were on top of the tree and emeralds, rubies and sapphires were below, but now they are seen as a real contender. They are much more in the front of the consumers’ mind than they were 10 years ago. Today, coloured gemstones are picked up by millennials and they are much more adaptable to fashion. The industry is just beginning to snow ball and I think we will see tremendous growth in the next 5 or 10 years.

Be the first to comment