Investment-led buying dominates festive season demand, with over 40 tons of gold sold in two days

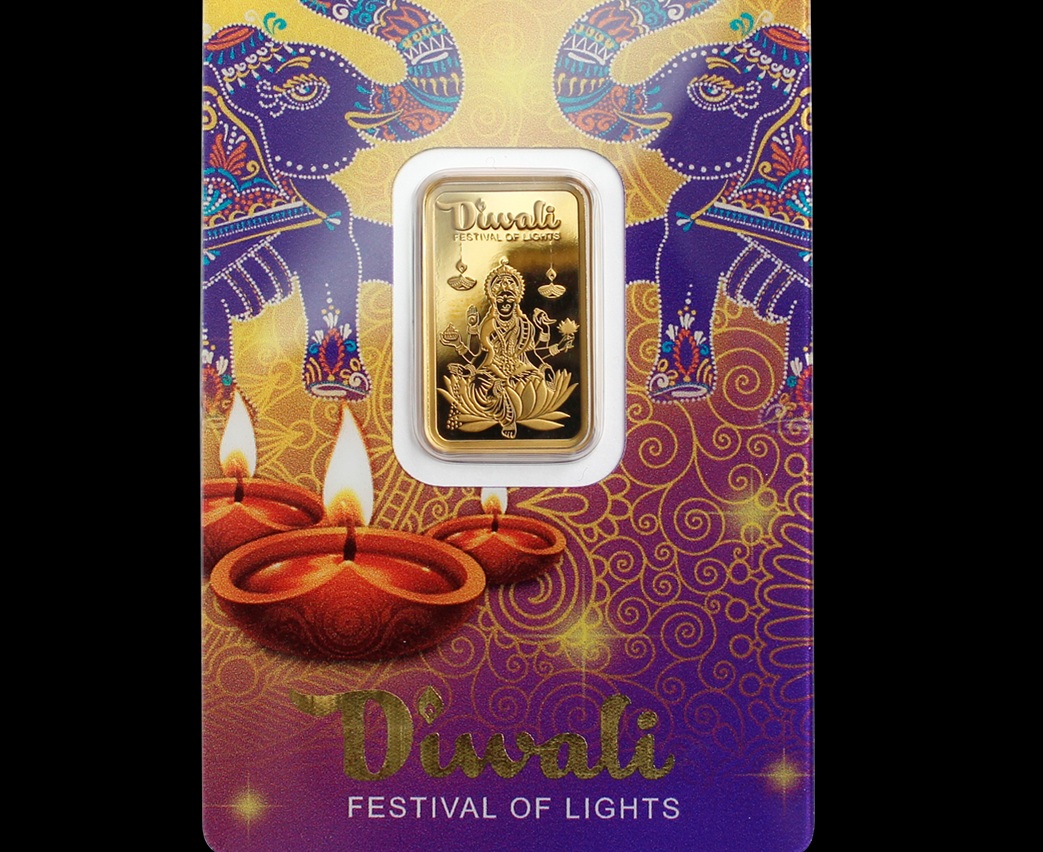

This Diwali, India’s love affair with gold glittered brighter than ever — but with a surprising twist. Instead of traditional jewellery, Indians rushed to buy gold coins and bars, spending an estimated Rs.700 billion to Rs.1 trillion ($8–11 billion) during the five-day festival, according to data from the India Bullion and Jewellers Association (IBJA) and the All India Gem and Jewellery Domestic Council (GJC).

On the first two days of Diwali alone, more than 40 tons of gold changed hands, as buyers prioritised investment over adornment. The bustling lanes of Mumbai’s iconic Zaveri Bazaar saw record footfall, with most customers seeking coins and bars rather than necklaces or bangles.

“This shift is striking — a few years ago, maybe one in ten customers would buy coins or bars. Now, it’s becoming the norm,” said Surendra Mehta, National Secretary, IBJA. He added that jewellery sales were down by about 30% compared to last year, signalling a change in buyer sentiment toward wealth preservation and portfolio diversification.

Major retailers, including Tanishq, reported a surge in investment-led purchases, with CEO Ajay Chawla cautioning that the brand could soon face a shortage of gold coins and bars amid unprecedented demand.

Gold prices have surged by over 55% this year, peaking at $4,000 per ounce earlier this month, fuelling optimism among investors. Industry experts expect prices to hit $5,000 by 2026, further reinforcing gold’s position as a safe haven amid global uncertainties and geopolitical tensions.

India remains the world’s second-largest gold consumer after China, with traditional buying peaks during the festive and wedding seasons. Yet, this year’s demand was largely investment-driven, reflecting global trends. According to Goldman Sachs, central banks — particularly in emerging markets — have increased gold purchases fivefold since 2022, marking what the bank calls a “structural shift in reserve management behaviour.”

A Morgan Stanley report estimates that Indian households hold an astonishing $3.8 trillion in gold, equivalent to nearly 89% of India’s GDP. This vast holding continues to underpin national wealth, even as gold becomes a hedge against a weakening rupee and volatile equity markets.

“Gold remains one of the best hedges against currency depreciation and market swings,” said Mukesh Jindal, Senior Partner at Alpha Capital, which advises several family offices in India. “We recommend clients allocate 5–10% of their portfolios to gold — through bars, coins, ETFs, or digital gold.”

Gold ETFs in India saw inflows six times higher year-on-year in September, reaching Rs.83.63 billion, according to the Association of Mutual Funds in India, highlighting the growing appetite for paper gold investments.

Despite soaring prices, overall Diwali gold sales volume was only 5% lower than last year, said Rajesh Rokde, Chairman of GJC. “Demand for gold remains robust — the form may have changed, but the faith in gold as an asset has not,” he noted.

As global central banks continue their monthly gold purchases and investors seek security in tangible assets, India’s festive gold rush proves that for millions, the yellow metal remains the ultimate symbol of prosperity, protection, and permanence.

Source: CNBC

Be the first to comment